A Kidderminster resident has been left “absolutely astounded” after his insurance company refused to pay for storm damage because wind speeds were 2mph too slow to qualify as an official storm.

Dennis Iliffe was denied a payout by insurance provider Ageas after Storm Darragh damaged his property last week.

The company insisted that because wind speeds in Kidderminster reached only 53mph, rather than the required 55mph threshold, the weather event did not meet their definition of a storm.

Ageas Claims director Stephen Linklater said: “While Mr Iliffe’s claim did not meet the standard definition of a storm, we review each case individually and asked for additional information for the work to consider Mr Iliffe’s case. Now that we have supporting information, we have agreed to settle Mr Iliffe’s claim.”

Iliffe’s chimney was damaged in Storm Darragh (file pic)

Getty

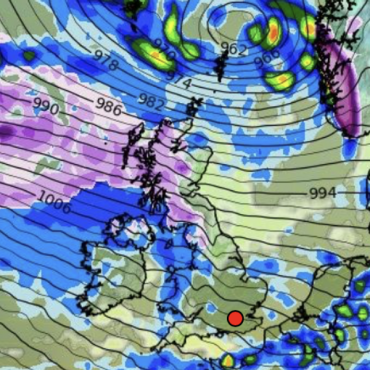

Storm Darragh caused widespread damage across the UK (stock pic)

Getty

Iliffe has been left £500 out of pocket after having to replace his aerial and repair his chimney following the storm damage.

“They didn’t want to know. They said the gust was only 53mph and it has to be 55mph to be declared a storm,” he told the BBC.

The damage wasn’t isolated to Iliffe’s property, with neighbours also suffering destruction to their homes during the severe weather.

Several properties on his street saw aerials destroyed and brickwork damaged, while roof tiles were blown off and one resident had their greenhouse windows blown out.

At least one of Iliffe’s neighbours has encountered the same problems with insurance claims.

LATEST DEVELOPMENTS

Some of the damage from Storm Darragh (stock pic)

Getty

The Association of British Insurers (ABI) has confirmed that a storm is officially defined as “a period of violent weather defined as wind speeds with gusts of at least 48 knots (55mph).”

Across the country, the storm caused unprecedented damage, with Birmingham City Council receiving 2,642 emergency calls during the weather event.

The storm’s impact was particularly severe in rural areas, where thousands of homes lost power.

Between 6am on Saturday and 10am on Sunday, firefighters across 38 stations in the West Midlands attended 122 weather-related incidents.

Iliffe expressed his frustration with the insurance system, saying: “You pay insurance, you think you’re covered. But when you come to make a claim, they don’t want to pay.”

Storm Darragh caused trees to fall down in Liverpool (stock pic)

GEtty

While acknowledging insurers may be wary of people using storms as a pretext for claiming on pre-existing damage, he questioned the logic of such specific thresholds.

“But what on earth are you covered for?” he asked. “If you have a fire, does the fire have to be a certain temperature? It beggars belief.”

The situation has been likened to “acts of God”, which are traditionally quoted by insurance providers as events they will not cover.

GB News has approached Ageas for a comment.

Post comments (0)