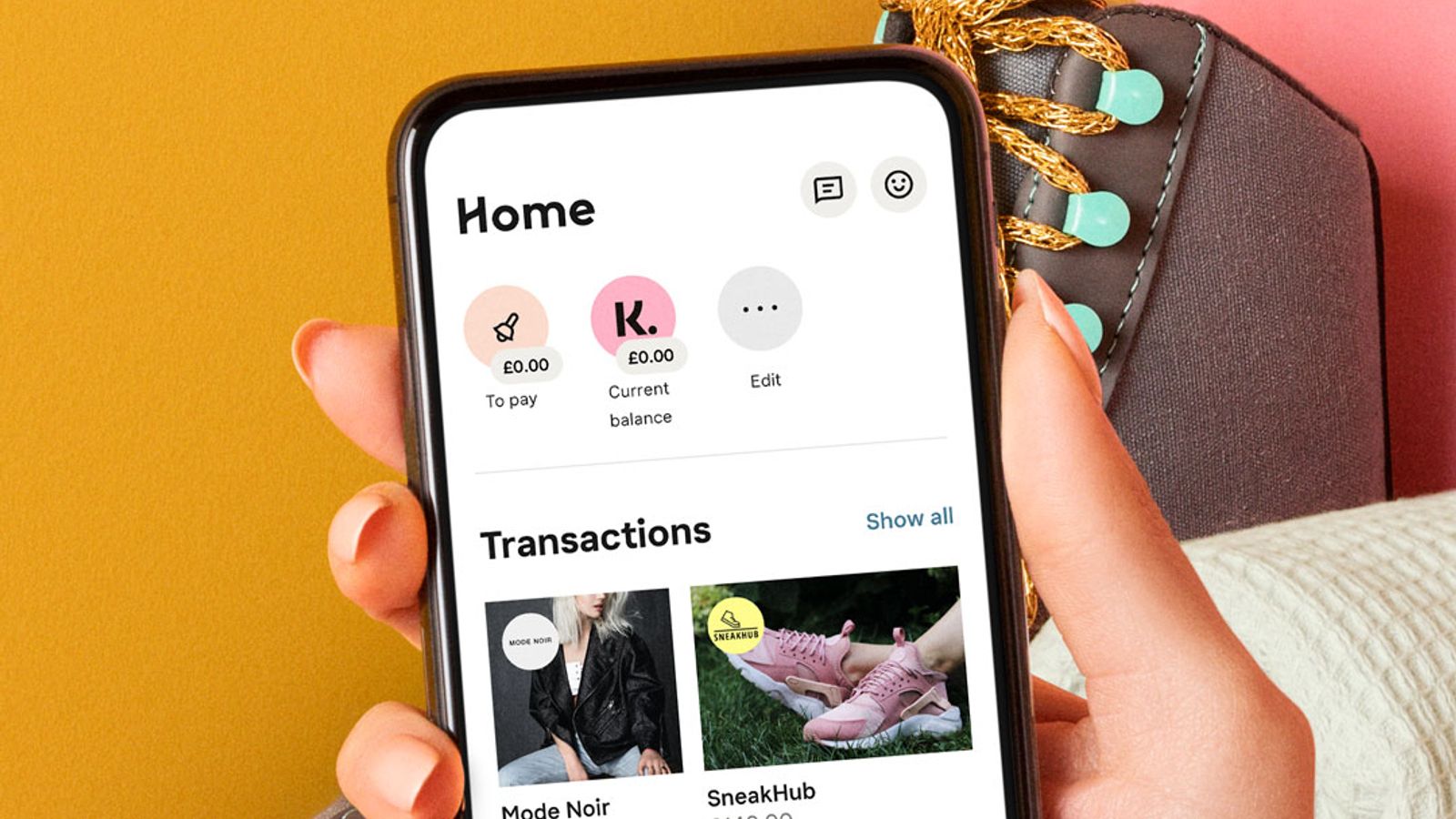

New rules to protect shoppers from spiralling into debt with Buy Now Pay Later (BNPL) products will come into force in 2026.

The measures mean companies offering BNPL will have to check shoppers can afford repayments before approving a loan.

Politics latest: Tory MP sparks outrage with Badenoch remarks

Firms will also need to provide clear information that the arrangement is a debt so consumers understand the risks of missing a payment.

The proposals will go through a consultation, with a view to laying the legislation in early 2025 and bringing it into force in 2026, the Treasury said.

BNPL products have become increasingly popular in recent years as they allow shoppers to spread the cost of purchases over time.

Campaigners like Money Saving Expert Martin Lewis have long been calling for greater regulation over concerns people are racking up too much debt.

Mr Lewis welcomed the announcement, saying Chancellor Rachel Reeves personally informed him of the news over the phone.

In a post on X, he said BNPL is “now ubiquitous at online checkouts, so the fact it’s never been regulated is a travesty I and others have long campaigned on”.

He said while BNPL can be useful, it’s being sold “as a lifestyle choice, not a debt, and pushed for instinct buys or even takeaways. Too many are in trouble with multiple BNPL repayments, leading to debt-chasing and credit file damage”.

X

This content is provided by X, which may be using cookies and other technologies.

To show you this content, we need your permission to use cookies.

You can use the buttons below to amend your preferences to enable X cookies or to allow those cookies just once.

You can change your settings at any time via the Privacy Options.

Unfortunately we have been unable to verify if you have consented to X cookies.

To view this content you can use the button below to allow X cookies for this session only.

The protections will put BNPL lenders under the scrutiny of the Financial Conduct Authority (FCA) and the Consumer Credit Act.

This will give consumers the ability to raise complaints with the Financial Ombudsman and claim refunds from the lenders if something goes wrong with a purchase.

A treasury source said the 2026 date was to give the FCA time to finalise its rules and companies the time to prepare for the changes.

Labour MP Stella Creasy questioned the timeline, saying it means another year of companies continuing “to exploit people with a form of lending the government says must change”.

“With Christmas on the horizon regulation cannot come a moment too soon… its critical when the consultation ends this happens as quickly as possible”, she said.

The FCA has itself been pushing for greater regulation, warning last year that more than a quarter of the UK population used BNPL in the six months to January 2023, and for some people it was becoming a “dangerous habit”.

Citizens Advice said it is helping more than twice as many people with a BNPL issue now than two years ago, and around a fifth of those are in need of food bank or charitable referrals.

Economic Secretary to the Treasury Tulip Siddiq said: “Our approach will give shoppers access to the key protections provided by other forms of credit while providing the sector with the certainty it needs to innovate and grow.”

Post comments (0)