This is a rush transcript. Copy may not be in its final form.

AMY GOODMAN: But explain what it means to appeal.

ELISABETH BENJAMIN: Sure.

AMY GOODMAN: I mean, what do you do first.

ELISABETH BENJAMIN: So, first of all, the first thing you should do if you get a claims denial is call your carrier and make sure that your provider submitted the right code.

AMY GOODMAN: And when you say “provider,” you mean your doctor?

ELISABETH BENJAMIN: Yes, your doctor. But it could be your hospital. It could be a doctor. It could be, you know, the pharmacist. I mean, so, that’s why we say “provider.” It’s sort of a euphemism for all these characters in your healthcare ecosystem. So, the first thing you should do is call the insurance company and understand why they’re denying the claim, and then, you know, circle back with your provider to make sure the right codes — if they say it’s a coding issue or they didn’t do a prior approval step or something like that, figure out what the problem is.

If you’re getting denied based on a thing called medical necessity, then you have a real chance in the appeal process to win. People on their own in New York state, thanks to Kevin and a bunch of us, we now know if people go to the state’s external review process, on their own, they win about 45% of the time. So, already, you have —

AMY GOODMAN: What is the state’s external review process?

ELISABETH BENJAMIN: Sure.

AMY GOODMAN: Who do you call?

ELISABETH BENJAMIN: So, after you exhaust, go through all the appeals at your insurance carrier, if you have a medical necessity denial or an experimental investigation treatment denial — so, if you have a denial that’s not based on whether it’s actually something that’s covered by your insurance — so, some people might ask your insurance company to pay for vitamins, and vitamins aren’t covered, for example, in that plan, so then you have no real basis for your appeal. You just have to do whatever the carrier does. But most people who are denied really are denied based on medical necessity. Then, you have the right to go through the state’s — first, the internal plan appeal process, which has very strict time limits, so make sure you understand those time limits. And then, if you lose there, in almost every plan in America now, you have the right to go to an external appeal agent.

And that agent in our state, it’s, you know, a contractor or three contractors for the state of New York. Those people have independent doctors that look at the healthcare plan’s decision. If you do that, you have a 50/50 chance of winning. If you come to us, you have an 87% chance of winning. So, having an expert really pushes you along the sort of external appeal win chance.

AMY GOODMAN: And what is peer to peer? This is now — this not only affects patients like Kevin. You have doctors spending much of their time, who wanted just to help patients, negotiating, what, prior approval, negotiating denials. The doctor then has to talk to an external doctor and say, “This is why we think that he shouldn’t need a new lung”?

ELISABETH BENJAMIN: It’s rarely a conversation. What the doctors have to do is even worse. They have to write like little dossiers in support. So, there’s no conversation. So, it would be — would that it was that easy. Sometimes the doctors get to talk to a nurse at United, but rarely it’s to another doctor. Often it’s nurses. Sometimes it’s AI, we understand now, more and more.

AMY GOODMAN: Artificial intelligence?

ELISABETH BENJAMIN: Is making some of these initial denials, is what we’re being told, although, you know, there’s other — some states are trying to make that illegal. It’s very bad, because the way we regulate insurance is we don’t. We basically let willy-nilly state do regulation. They do their best, but if we had a real understanding, a real transparency about these denials and the nature of these denials, I think we would all know a lot more, and maybe improve the system for everybody.

AMY GOODMAN: Do people answer the phone if you call up with a denial?

ELISABETH BENJAMIN: Eventually. I mean, wait times are not unheard of with any customer servicing.

AMY GOODMAN: And, of course — and this is when you’re getting sicker and sicker.

ELISABETH BENJAMIN: Yes.

AMY GOODMAN: So you’re fighting the insurance company and fighting cancer.

ELISABETH BENJAMIN: Yeah. And there’s a thing called — in that case, there’s a thing, a proven phenomena, called financial toxicity. And so, as you’re dealing with medical debt or as you’re dealing with an insurance claim, it actually exacerbates your physical condition. This has now been documented. And so, for cancer survivors, there’s a very important study in The Journal of the American Medical Association. They’re saying cancer survivors, as a result of the compounding financial toxicity, lose about one year of life and, you know, many more days in morbidity. So, it’s quite upsetting. And this is only happening in the United States, by the way. We don’t have this financial toxicity issue in any of the other, you know, OECD countries. So it’s a uniquely American phenomena.

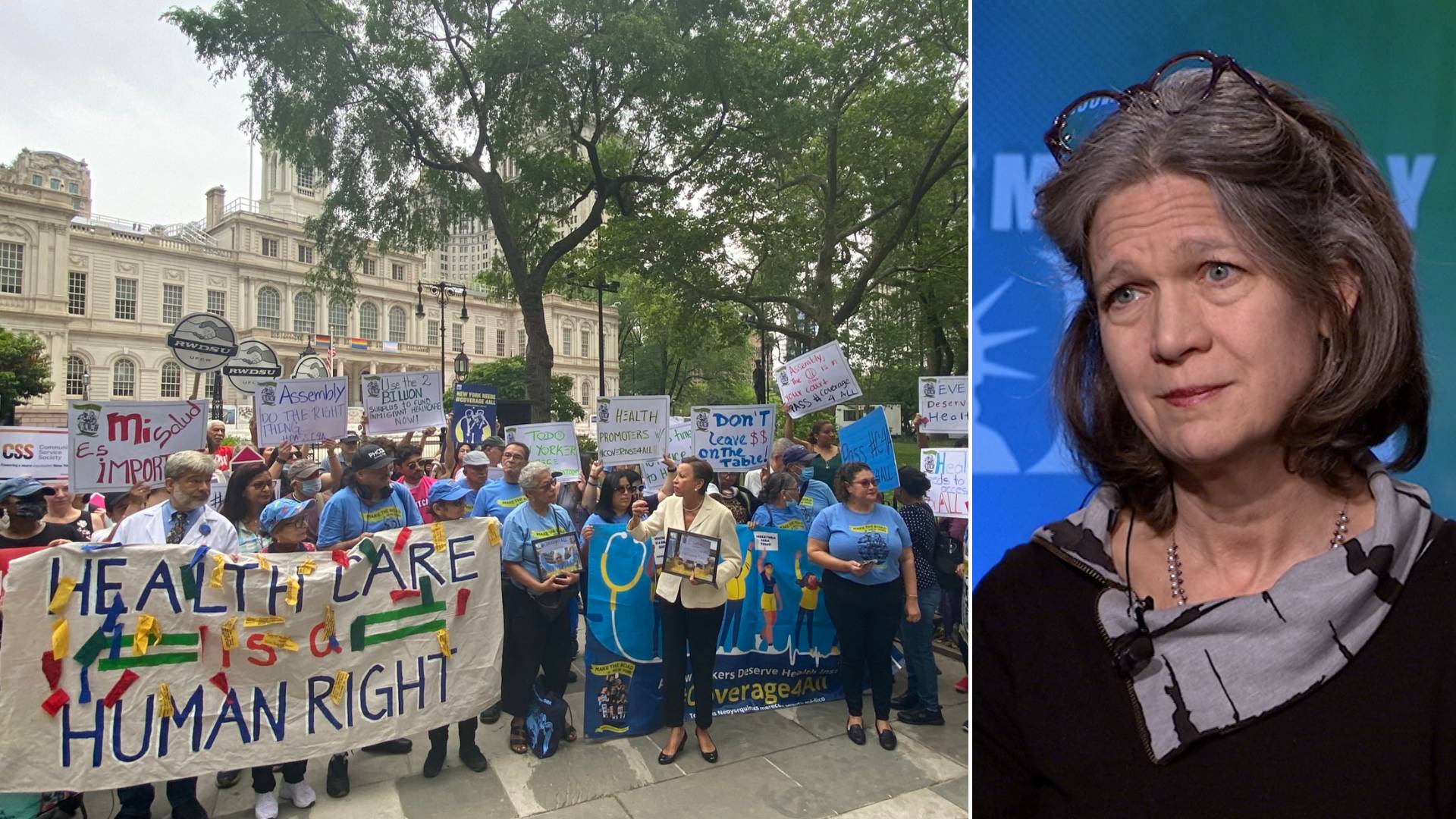

AMY GOODMAN: And you’re one of the founders of New York Health Care for All?

ELISABETH BENJAMIN: Yes.

AMY GOODMAN: That goes to the issue of Medicare for All, of universal healthcare. That’s the phenomenon that is — what we experience, they’re not experiencing in those countries, because they have basic healthcare.

ELISABETH BENJAMIN: Yes.

AMY GOODMAN: So, talk about what that would mean. And the other issue you raised is the issue of medical debt, something else we just have here in this country.

ELISABETH BENJAMIN: Right. Because we have this whole free market system for healthcare, which is — you know, it’s a free market health system, so you have the carriers, who have their financial interest, insurance plans, and then you have providers and hospitals, who have all their financial interests. Those entities are — and the pharmacy — Big Pharma has its own financial interests. All of those entities are in sort of this nuclear arms race. Everybody has an incentive to charge more, right? Health plan makes more money because they just charge all of us more on premiums.

So, they have — we all thought that the health plans would negotiate better hospital prices with the hospitals. What we’ve seen in a place like New York, the health plans are required, basically, to have all the hospitals, all the fancy hospitals, in their networks. So there’s no price controls happening. There’s no real — economics 101, the microeconomics we all might have learned in college or graduate school or whatever, it doesn’t work in healthcare, because it’s an urgent, visceral — you have to have it. No one has bargaining power in this system. And so, all the big financial interests just have an interest in making more money.

So, I think what happens in other countries is, for example, even in Switzerland, which has private health insurance, the government sets the reimbursement rates for the providers, for the drugs. And so, the insurance companies are administering, private insurance is administering, but they’re not administering the reimbursement rates. New York state used to set hospital reimbursement rates, and we got rid of that in favor of a free market system, which — and what’s happened, our healthcare prices have gone up, and now we have the second most expensive healthcare in the country.

AMY GOODMAN: And you’re one of the leaders on tackling medical debt. What is happening in the country around that, state by state?

ELISABETH BENJAMIN: Well, what’s amazing is that people are really fighting back. So, here in New York state, we did an inventory of all the hospital lawsuits against patients, showed that about 13,000 hospitals were — 13,000 patients were being sued by hospitals every year. We then went on this campaign.

AMY GOODMAN: So, the sickest patients are being sued by hospitals saying, “You’ve got to give us money.”

ELISABETH BENJAMIN: Right.

AMY GOODMAN: Even though often they have a large charity disbursement that the patients didn’t know about —

ELISABETH BENJAMIN: Right.

AMY GOODMAN: — that if there’s a person who can’t afford, they get the money from the state.

ELISABETH BENJAMIN: Especially in a place like New York, where every one of our hospitals is a nonprofit charity. So, I work for a charity, and we never sue our patients — I mean, our clients. So I’m not sure why hospitals think that — a nonprofit charitable entity thinks it’s OK to sue their patients. Whole other story.

But we just — from the people fighting, which is what is really starting to happen throughout the country, like what we did in New York is really spreading like wildfire, even in places like North Carolina that aren’t known for their progessive policies necessarily. We started fighting back. We changed the statute of limitations. Hospitals now only have, and medical providers only have three years, instead of six years, to sue people. They used to be able to charge 9% interest; now it’s 2%. We no longer allow them to be able to report medical debt to the credit reporting agencies, so the debt collectors can’t, like, hound you and terrify you into it, especially since we know from medical — if you have medical debt, you’re more likely to be a better credit risk than a bad one. So, why would it ever be on your credit report? It’s just crazy. No longer can they take — get this: They used to take liens on people’s homes, primary residences. They used to be able to take — garnish wages of working people. Gone. No longer allowed to do that. And then, finally, we made a total ban on suing anybody below 400% of the federal poverty level, which really saves —

AMY GOODMAN: How many states have this, though? This is New York.

ELISABETH BENJAMIN: This is New York. But we’re seeing other states do that. Maryland has something very similar. The unions, in partnership with the people, have done a great job in their campaign in Maryland. We see some movement in Maine, Massachusetts, Illinois. Colorado has done a lot of work around this area, too. So, it’s —

AMY GOODMAN: What would Medicare for All look like? How would that change the landscape for people, the health of the nation?

ELISABETH BENJAMIN: Well, first of all, right now we spend more, around 16% of our GDP, on healthcare. If we had a Medicare for All system, that would probably — even in the most expensive other industrialized country, it’s around 10%, 12%. So we would save billions, trillions probably, if we had Medicare for All. And so, all of that could go into paychecks and making people’s lives better, right? So we would have the money instead of giving it to these big industries.

The second thing that would happen is that we wouldn’t have people with a thing called deductibles and coinsurance, so in a way to deter utilization. The industry tries to vilify patients, like we’re just desperate to overconsume healthcare. That’s actually not true. We have the lowest average length of stays in hospitals compared to any OECD country. So it’s not about patient utilization. It’s truly about the prices. And there was a famous Princeton economist, Uwe Reinhardt, who died. He had said, “It’s the prices, stupid.” And it really — and that was a famous article. But it’s still true these 20 years later. So, it’s very sad.

If we had Medicare for All, we wouldn’t be paying as much, and we would probably have much better health outcomes, because people — it wouldn’t be irrational if Kevin gets his treatment or not. People would — you know, we’d have a higher life expectancy. We’d have better health outcomes. We could monitor quality, enforce quality around the system. It would just be so much easier for patients. Patients wouldn’t have medical debt. You know, providers wouldn’t be spending time with the insurance company on paperwork. They could be actually providing healthcare to us.

AMY GOODMAN: And the discussion is going in the other direction with the new administration, not just not Medicare for All, but privatizing Medicare and Social Security.

ELISABETH BENJAMIN: Right, which means that there’s more cost sharing for patients — right? — deductibles, coinsurance, higher copays. And it’d be one thing if we had — all of those things were structured in a way to incentivize people getting care. So, for example, what that means is if someone has diabetes and needs insulin, we all want them to have insulin. If they don’t take their insulin — they shouldn’t be rationing their insulin. If they don’t take their insulin, they’re going to lose a foot. That’s super expensive for all of us, right? But instead, we put copays and deductibles on insulin. So, what’s amazing is, really smart states, like New York last year under Governor Hochul and the superintendent of financial services, said, “We’re going have zero copays for insulin. Like, why? Why would you ever charge people for insulin, period?” That should just — the insurance company should want to have that person using their insulin. We should be doing that for a range of medications to really be improving healthcare for people, instead of for profit.

AMY GOODMAN: Well, we’re going to leave it there. I want to thank you both for being with us. Elisabeth Benjamin is vice president at the Community Service Society of New York and co-founder of Health Care for All New York campaign. And I want to thank Kevin Dwyer, who has cystic fibrosis, was denied lifesaving medicine by UnitedHealthcare for nine months, until the Community Service Society, The Today Show, lawyers all got involved, so that he could have the same healthcare that his sister had from the same insurance company. Astounding story.

Coming up, “Don’t Obey in Advance.” Yale historian Timothy Snyder on everything from Trump’s billionaire Cabinet to ABC News’ multimillion-dollar settlement with Trump. Stay with us.

[break]

AMY GOODMAN: “We’ll Inherit the Earth” by The Replacements. Guitarist “Slim” Dunlap passed away Wednesday at the age of 73. And as we come to the end of the year, we’ve been playing a lot of the music of musicians who have passed in this past year.

Post comments (0)